PropNex Picks

|November 26,2025Resale Landed Market Watch In October 2025

Share this article:

Improving Resale Land Prices with improved market sentiment in October

Landed home resale activity in October recovered following a slowdown in September due to the seasonal lull from the Hungry Ghost Month. Based on URA Realis caveat data, about 184 landed homes were transacted on the resale market in October 2025; the combined transaction value came up to $1.07 billion - compared to September (184 deals valued at $1.12 billion). Upon an analysis of each transaction and their respective gains, most landed deals were profitable.

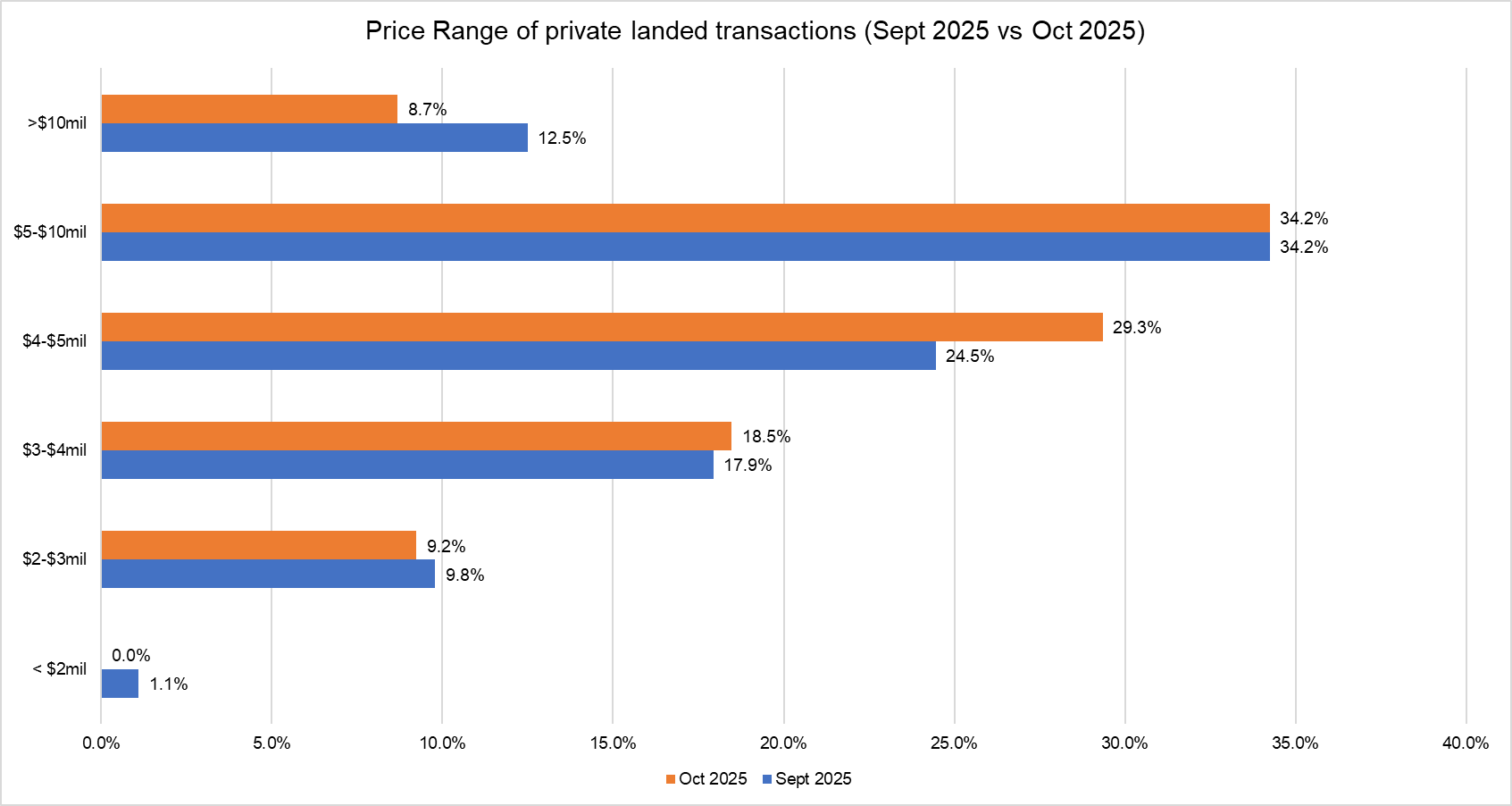

There was a lower proportion of higher priced landed homes being sold compared with the previous month despite an increased sales momentum. Based on URA Realis caveat data, about 43% of resale landed homes sold in October were priced at $5 million and above, compared with about 46.7% in September. Meanwhile, 57% of the resale landed transactions were priced at below $5 million in October - growing from the 53.3% proportion in the previous month.

Chart 1: Price range of private resale landed transactions in September 2025 vs October 2025

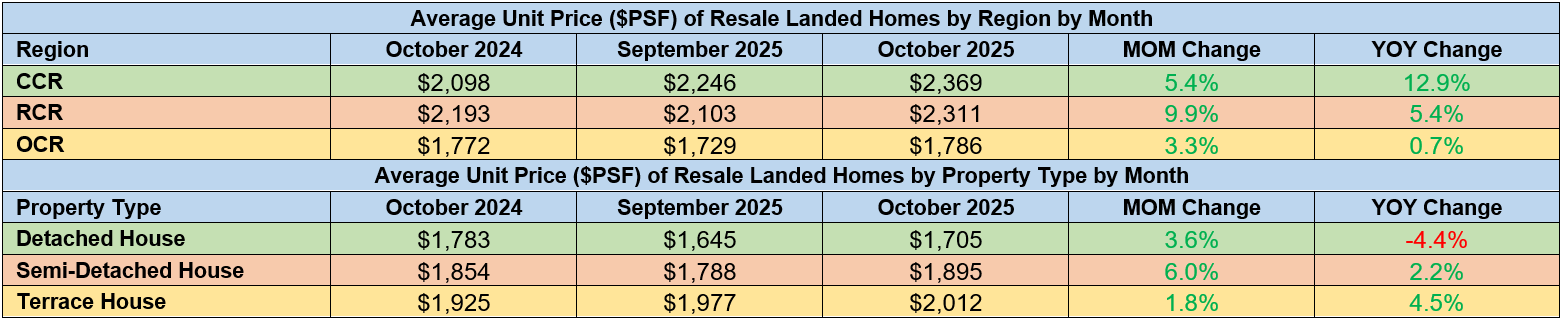

Growth of landed home resale prices in October 2025 was relatively homogenous. The overall landed homes resale prices rebounded by 3.7% month-on-month (MOM) to $1,944 psf; while prices were up by 2.5% compared to a year before. The month-on-month increase in resale landed prices was led by the growth of prices in the Core Central Region (CCR) and Rest of Central Region (RCR) and which expanded by 5.4% and 9.9% MOM, respectively. Homes in the Outside Central Region (OCR), also expanded, strengthening by 3.3% MOM. By property type, detached and semi-detached homes saw average prices increase by 3.6% MOM and 6% MOM respectively in October. (see table 1 below).

Table 1: Average Unit Prices ($PSF) of Resale Landed Homes by month

Resale landed homes performance by property type in October 2025

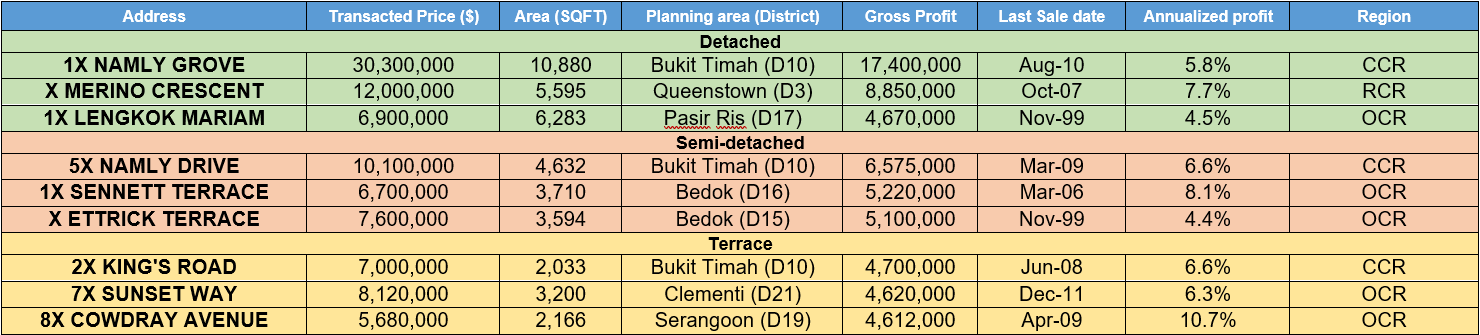

Table 2: Top 3 resale landed transactions by landed property type, in terms of estimated gains*

*Gains are derived from the resale transaction for each unit against the unit's last caveated transaction. The gains reflected is gross - it has not accounted for the applicable seller's stamp duties, interest payable, taxes and other relevant divestment costs.

**Annualised gain is the compounded annual rate of return which shows the rate of return over the time period between the point of resale and the property's last caveated transaction, expressed in annual percentage terms. The formula for determining this is simply: [(current resale price) / (purchase price)] time period in years-1

Top landed transaction with highest gains (Detached)

The top performing detached home transaction and overall landed transaction for the month was for a bungalow along Namly Grove in District 10 (Bukit Timah) that was sold for $30.3 million, up by more than $17 million from the last caveat lodged in August 2010 - this reflects an annualised profit of 5.8% after a holding period of nearly 18 years. The freehold property is situated within the Shamrock landed area, has a land area of nearly 11,000 sq ft which reflects a unit price of $2,785 psf on land area.

Top landed transaction with highest gains (Semi-Detached)

The best-performing semi-detached transaction was for the sale of a semi-detached property in Namly Drive in Bukit Timah (District 10). It was sold for over $10 million in October, with its last caveat being lodged in March 2009. The sale price is up by nearly $6.6 million from the previous caveated price, representing an annualised gain of 6.6% per year over 16 years. The freehold property is situated within the Shamrock landed area..

Top landed transaction with highest gains (Terrace House)

The best-performing terrace home transaction was for a terrace house along King's Road in Bukit Timah (District 10). The freehold property was sold for $7 million, reflecting an estimated gain of $4.7 million, representing an annualised gain of 6.6% per year from its last caveat lodged in June 2008, with a holding period of over 15 years. The freehold property is situated within walking distance to Botanic Gardens and a number of commercial amenities in the area, including Cluny Court, Serene Centre and Coronation Plaza.

If you are looking for high-end homes or good class bungalows in Singapore, contact PropNex's GCB and Prestige Landed department for buying and insights on the landed residential property market.

For more property research insights, join PropNex Friends today.