PropNex Picks

|November 20,2025Your Income Will Probably Never Catch Up to Property Price

Share this article:

"I'll wait til I earn more"

It's something that many of us have said before. We tell ourselves we'll buy a home later, once we've saved more, earned more, or felt "ready." But once we've saved enough, the same home is now almost double in price!

Now, don't get me wrong, I'm not saying all this to discourage you. It's just the cold hard truth. And the sooner you accept it, the sooner you can stop wasting your time waiting for the "perfect" moment. Because let's be real, it might never come. So, it's better to just start building a proper game plan.

Back in our parents' time, owning a home by 30 was almost a given. As long as you have a steady job, you can save for a few years and afford a decent flat. But today, that same dream is a lot harder to achieve.

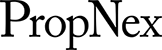

In 2000, the average monthly income (including bonus) earned by all working household members, before taxes or government payouts, was $1,586. By 2024, it reached $4,226. That's a 166.5% increase. It doesn't seem too bad until you realise condo prices have at least tripled during the same period.

Source: PropNex Investment Suite

It's not just because of inflation. Land scarcity, global investment interest, and higher construction costs have all played a part in pushing up property values. And despite cooling measures, property prices continue to go up. Meanwhile, wage growth has been tempered by productivity ceilings and slower economic expansion. So yes, today's 30-year-olds have to work a lot harder and plan much smarter than the 30-year-olds from a generation ago.

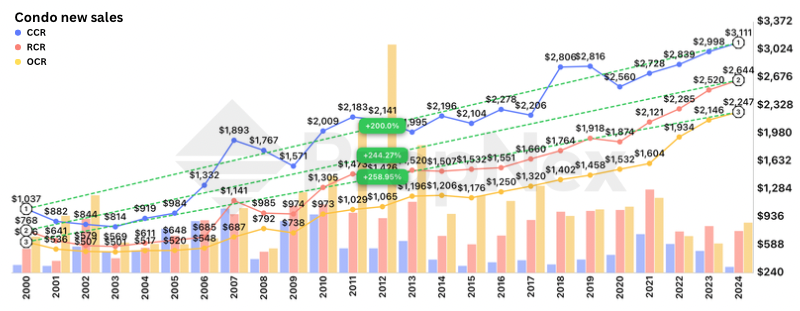

And I know you're wondering, what about HDB? Unfortunately, it's not that much better. Resale prices have surged by around 140 - 185% over the same period.

Source: PropNex Investment Suite

And while on paper it may seem closer to income growth (even slightly slower for OCR), this comparison can be misleading. We need to remember that we're talking about a six- perhaps even seven-figure purchase here. Even a small percentage jump can translate to tens or hundreds of thousands more. Not to mention that a large portion of our income is already allocated for daily expenses that have also climbed with inflation, leaving far less room to save or invest.

That's why the whole "I'll wait til I earn more" logic doesn't apply in real life. It's like our paychecks are walking up the stairs, but property prices are going up on an escalator. Waiting for your income to catch up means buying later at an even higher price. Meaning you're paying more for the same home.

You may not want to hear it, but the earlier you start, the more time you give your equity to grow with the market instead of trying to catch up later.

I'll give you an example. Let's say two couples each plan to buy a $400,000 resale HDB flat. The first couple decides to purchase a flat at age 25. The second couple wants to wait until they're 35, thinking they'll be more ready then. But in those ten years, assuming prices grow just 4% per year, that same flat now costs about $592,000.

Both couples take a 25-year loan at 80% financing and 2.6% interest. The difference? The younger couple locked in a lower price and started building equity right away. By the time they're 40, they've already paid down a good portion of their loan and seen their property appreciate in value.

Meanwhile, the couple who waited is just getting started. They're paying more for the same kind of flat and owning less of it compared to their loan amount. Fast forward another decade, and the first couple could already be debt-free or upgrading to a second home, while the other is still paying off their first.

The good news is that you don't need to be mega-rich to start owning property, you just need leverage.

With a mortgage, you're not buying the whole home up front. You start with a down payment and gradually pay the rest over time. It's how ordinary people can own an appreciating asset. Then, as your property value grows and your loan gets paid down, your equity (the portion you truly own) grows too.

This forms the basis of many successful property journeys: starting small, growing equity, and moving upward strategically. You start with something within reach, maybe a BTO or a resale HDB. You let time, appreciation, and repayment build up your equity. Then, when the time is right, you can unlock that equity to upgrade or invest in another property.

Here are some options to get you started:

- HDB flat

Buy an HDB flat as your first home for the most affordable option. If you choose to get a resale flat, you can also skip the BTO waiting time and move in much sooner, which means you start building equity earlier too.

- Condo

If you can stretch a little, consider a small condo unit in an up-and-coming area. Don't worry, choosing condo over BTO does not make you atas. Condos can actually offer faster appreciation potential depending on location and upcoming developments (read more about URA's master plan here).

- Executive Condominium (EC)

EC is a good way to enter the private market at a lower cost while still enjoying capital growth potential.

Before you start viewing homes, make sure you:

- Know your limits

Keep your monthly housing costs (including mortgage, insurance, and other debts) to around 30 - 35% of your take-home pay. Use our online calculator to see what you can comfortably afford.

- Check your grants

If you're a first-timer, don't miss out on HDB grants. They can seriously cut down your upfront costs. Take some time to understand what you qualify for and how to apply.

- Get pre-approved

Get in-principle approval for your loan. It gives you a clear budget. Then, test what happens if interest rates rise by 1 - 2%. Make sure you can still manage the payments.

- Plan your CPF

Decide how much of your CPF OA you'll use for the down payment and monthly repayments. Also remember, when you sell later, you'll need to refund what you used plus accrued interest.

- Build a safety buffer

Set aside at least 6 - 12 months of expenses outside your property budget. This keeps you secure in case something unexpected happens.

- Talk to the right people early

Seek professional help before making big moves. A bit of advice upfront can save you a lot of stress later.

The gap between income and property prices isn't going to close up. In fact, it has only grown wider over the years. So waiting to "earn enough" is like chasing a moving target. The truth is, the best time to start is now. Otherwise, homeownership will feel more and more out of reach.

You don't have to start big, you just have to start smart. The best time to start isn't when you've 'earned enough', it's when you've understood how to make your assets work for you. Let your first home be more than just a roof over your head. Let it be your entry point to long-term stability and financial growth. When you understand how to use time, leverage, and equity, you stop chasing the market. You move with it.

At the end of the day, property ownership isn't just about having a place to live. It's about building a future where your assets work for you. And if you want to learn how to map out your own step-up plan, join us at the upcoming PWS Masterclass and hear it directly from the people who've helped thousands of homeowners do exactly that.

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position. No part of this content may be reproduced, distributed, transmitted, displayed, published, or broadcast in any form or by any means without the prior written consent of PropNex.

For permission to use, reproduce, or distribute any content, please contact the Corporate Communications department. PropNex reserves the right to modify or update this disclaimer at any time without prior notice.